When working with business owners who are looking to make investments outside of their business, I am often asked whether it is better to use RRSPs and Individual Pension Plans (IPP) to establish retirement savings or whether it makes more sense to leave those funds in one’s corporation for investment purposes. While the answer to this question is often driven by your accountants preference for salary vs. dividends, your type of business or profession can also play an important role.

Earlier this year, Jamie Golombek, CPA, CA, CFP, CLU, of CIBC’s Wealth Strategies Group published an interesting article (RRSPs: A Smart Choice for Business Owners.pdf) providing an excellent comparison on this issue.

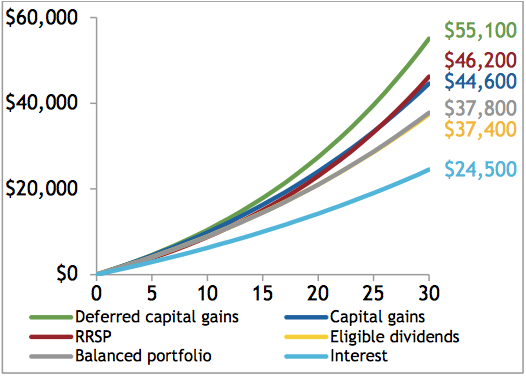

Amount of after-tax investment income to shareholder with RRSP vs. Corporate investing

What can we learn from this?

The integration of our tax system attempts to level the playing field between earning income as an employee (salary) and as a business owner (dividends). As a rule of thumb, investing through an RRSP will provide better after-tax results in the majority of cases. If you are earning less than $150,000 per year and your are interested in maximizing your investment results, then you should probably consider paying yourself sufficient salary to max out your RRSP while using dividends for amounts above this threshold. If you’re earning in excess of $150,000/yr, then you may want to also consider the benefits of an Individual Pension Plan to further increase these ordinary RRSP contributions.

As always, it important to consult with a qualified tax professional to determine the very best strategy for your unique circumstances.